The Millionaire Fastlane (MJ DeMarco) – Book Summary, Notes & Highlights

🚀 The Book in 3 Points

- The "fastlane" implies that it is possible to get rich "quick", but that shouldn't mean it's easy. If it's advertised and easy, it is a scam. Avoid "Too good to be true".

- Relying on time-related factors like getting some sort of degree, waiting for the stock market to go up, and other factors as the ONLY means of increasing your wealth is actually putting you on the path of the "slow lane" because you're trading your money for time.

- Think like a creator rather than a consumer; there is a high ratio of consumers as opposed to creators of some sort of solution and you could be the one to offer something to this market that no one else has done as well as you yet. People will pay you for it!

🤔 My Impressions of the Book

The book is generally well-written but repetitive in some parts. Some parts of the book were not new to me personally but if I were to be reintroduced to this genre of business/self-help books, I would rather it be this book than the 4 hour workweek because the advice in this book was more timeless. The book does not read like a "motivation" book, but asks you to consistently question yourself about why you can or can't do something, which in and of itself is intrinsically motivates me to start thinking of something I could offer to the world as a solution to their problems.

👤 Who Should Read It?

Everyone who does not already own a business that's making them money if they are not even there and anyone who has a net worth at 100,000 USD or less. The point of this book is to speed up your earnings potential while weaning you off your status as an employee who works 40 hours a week to earn money no matter how much; because in the end, your most valuable asset is time you have to live on Earth, not money.

🧙🏼♂️ Top Quotes

Thinking never made anyone free (or rich), unless that thinking manifests itself into consistent action toward application of laws that work.

Wealth cannot be accelerated when pegged to mathematics based on time.

I don’t know your age, but let’s be honest and ask the uncomfortable question: Can you seriously expect to retire on $19,000 in net worth? Or $119,000? Is it rational to think you can live off your home equity refinance? Have you thought beyond next week’s paycheck? At what threshold do you realize that it’s time to shift gears and reevaluate? Is there a threshold? Why would something that you’ve been doing for 5, 10, 20 years suddenly start working?

Yes, insanity is doing the same things repeatedly and expecting different results

🖼️ Frameworks

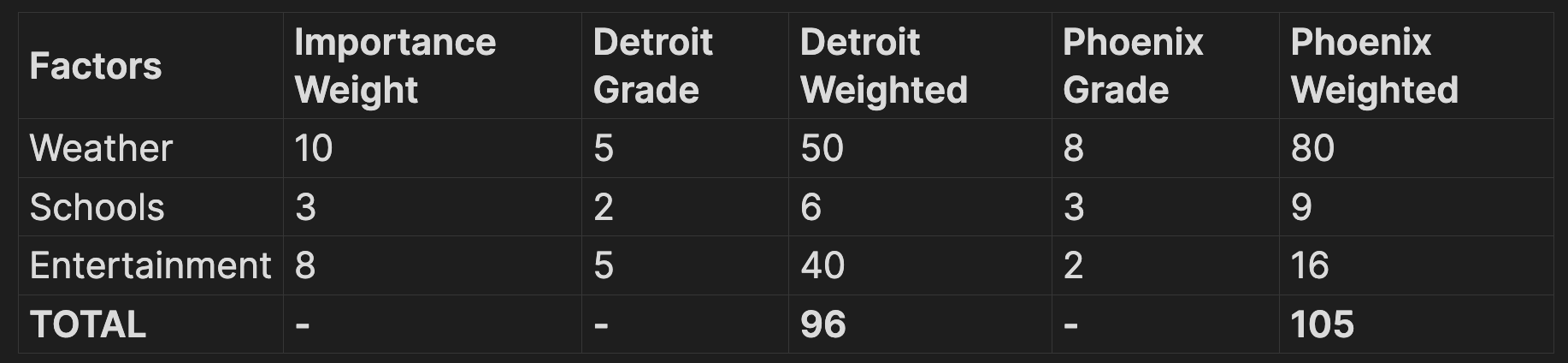

1.Weighted Average Decision Making Matrix (WADM)

The main purpose of this tool is to figure out what factors you value the most when making a decision about doing something or going somewhere and weigh those factors higher in your decision scoring.

The Weighted Average Decision Matrix (WADM) is a structured tool designed to aid in making difficult decisions by assigning quantitative values to different options based on various factors. This method involves listing down all relevant factors for a decision and assigning them a weight (importance) on a scale of 1 to 10. Then, for each option being considered, each factor is graded on the same scale. The grade for each factor is then multiplied by its weight, and the results for all factors are summed to provide a total score for each option. The option with the highest score is considered the most favorable.

Here's an example for someone deciding to make a move to an American city:

In this example, based on the factors considered and their weights, Phoenix has a higher total score, making it the more favorable choice. Note that some cells were left as "-" because what we care abot here is the weighted totals, not the unadjusted totals.

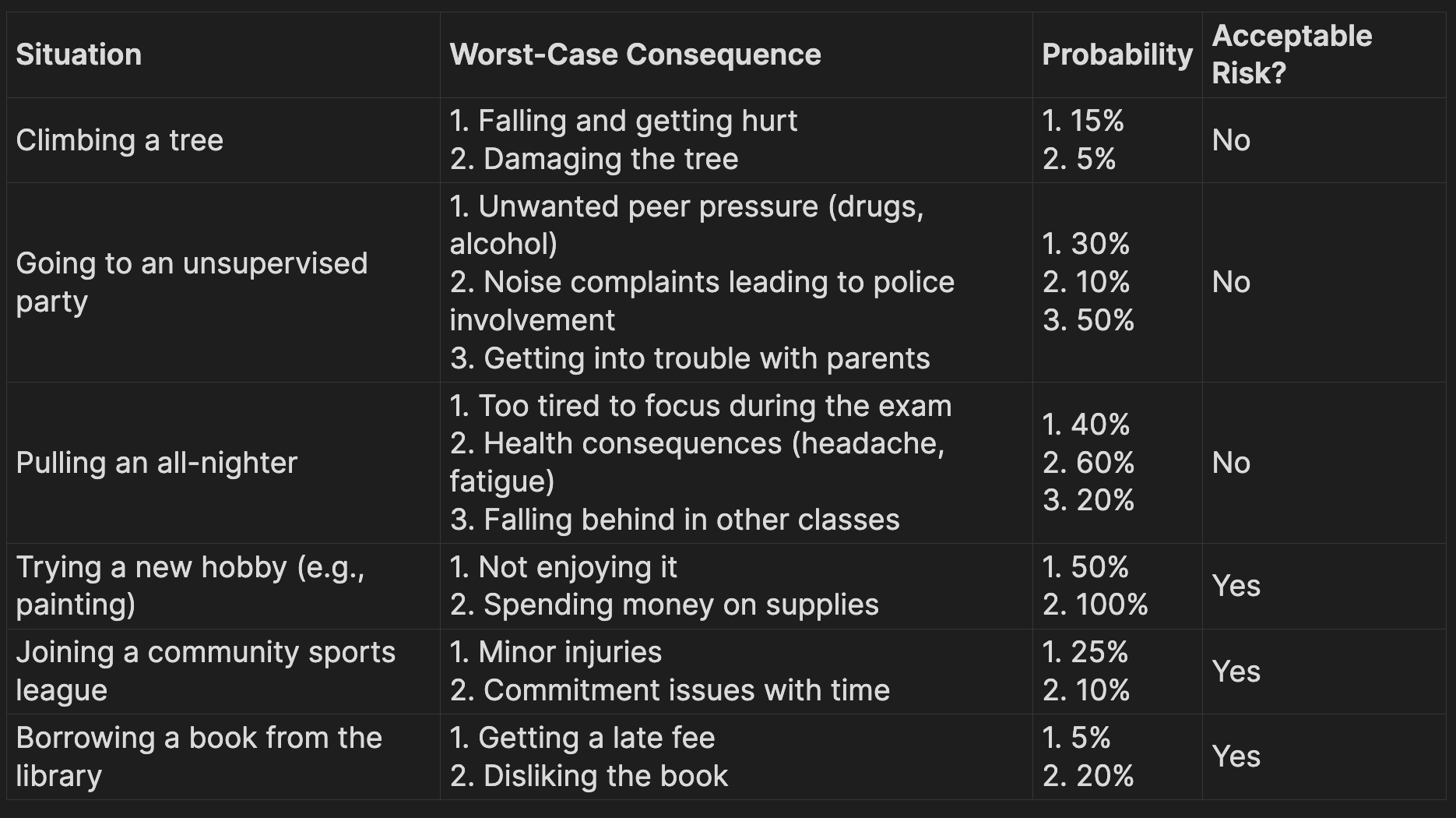

2.Worst Case Consequence Analysis (WCCA)

The Worst Case Consequence Analysis (WCCA) is a decision-making tool that requires forward-thinking to analyze potential consequences of decisions. It entails answering three questions about any significant decision:

- What could be the worst outcome of the decision?

- What is the likelihood of that outcome?

- Is the associated risk acceptable?

This process helps in avoiding potential disastrous outcomes.

Here is an example I made of this tool being used for various decisions:

🪄 Top Actionable Takeaways

This book boils down to these principles to have in mind when running an entrepreneurial venture. Conveniently, taking the initial letters of all the items below will spell out "FASTLANE SUPERCHARGER".

- 🧪 Formula: Wealth is generated through process, belief systems, consistent actions, and habits. In fact, the rest of this list of 20 items IS in and of itself, part of this formula. All these things interplay like garden and your gardening tools and materials. You need the right seeds and care and cannot assume it'll magically happen by happenstance.

- 🙇🏻♀️ Admit: Recognize the flaws in solely relying in the traditional "Get Rich Slow" methods and believe in a faster route to wealth. Instead of saving pennies over decades based on time, think about starting a business and creating assets based on how much product you are able to sell.

- ✋ Stop and Swap: Disband old wealth-building strategies and embrace the Fastlane approach. Don't just save and let your money depreciate over time, invest in a startup.

- ⏰ Time: Prioritize free time, and spend time doing activities that reward you with more than just money that can pay dividends to your future life. Rather than watching TV, use that hour to learn a new skill.

- ⚖️ Leverage: Use powerful methods to build wealth, not just relying on fixed incomes. Don't just rely on a 9-5 job; start a side hustle in your spare time that doesn't rely on fixed income at a fixed time.

- 💸 Assets and Income: Focus on increasing income and the value of assets. Assets are things that make money for you (e.g. a video course you sell online), as opposed to a car which is a liability (loses money for you). In other words, instead of just cutting costs, find ways to increase earnings as well!

- 🔢 Number: Quantify it. Define the exact amount of money and resources you need for your dream lifestyle and track your progress towards it. Want to retire with $2 million? Break down how you'll get there to its every minutiae rather than attacking it as a big whole thing. In other books, there is a similar technique called "Dreamlining".

- 🥚 Effection: Positively impact a large number of people, not just your neighbourhood, but try to see if you can scale it up to global. Develop a product that benefits millions, not just a few. Digital products sold on the internet often make this hurdle virtually non-existent.

- ☸️ Steer: Commit to your formula (from step #1) and understand that your past financial decisions brought you to where you are today. Do not waste your time blaming things on the world, because you can't do anything about them. Only focus on things in your power and steer yourself when some speed bumps come in your way. For example, if you've moved from a job to owning a business, reflect on what triggered that change and how you will stay and adjust while taking this route.

- 💔 Uncouple: Start your business in a way that aligns with Fastlane principles. Namely, that you are not the sole proprietor of the business and that you are not serving the role of an employee with the guise of being an employer. Otherwise, it's another job, and that doesn't change you from being in the "slow lane" or "side-walk" of this lane. Move from being an employee to owning an LLC.

- 🔥 Passion & Purpose: Use your passions and purpose to fuel your journey. Love gaming? Start a gaming blog.

- 📚 Educate: Never stop learning and seeking knowledge that aids your Fastlane journey. (Spend 30 minutes daily reading industry news.)

- 🛣️ Road: Look for business opportunities by identifying unmet needs or inefficiencies. Notice a product flaw? Something that consumers always complain about in the current market of a product? Take the product idea and create a better version!

- 🛂 Control: Maintain control over your business decisions. (Rather than using third-party platforms, launch your own website.)

- 🤲 Have: Offer something that people truly need or desire. Develop a solution to a common problem many face. An idea would be to give it away for free if others are charging for it.

- 🤖 Automate: Make your business run on its own, freeing up your time. For example, use Stripe an automation apps to handle bookings while you sleep. Remember, you want to remove yourself from the equation of time needed to use your own hands in your business so that you can think of the company's vision.

- © Replicate: Expand your business to reach a larger audience. Turn a local business into a franchise. Something also heavily emphasized in another book E-myth revisited

- 📈 Grow: Always strive for improvement and think of your business in a multidimensional and non-linear way. For example, don't just sell shoes; create a recognizable brand. People can buy shoes from anyone, but they are more comfortable buying from a brand they have a connection with.

- 📤 Exit: Know when to cash out or move on from a venture. Sell your thriving business and move to a new venture when it's necessary.

- 🔁 Retire, Reward, or Repeat: After achieving success, decide on the next steps, but always reward yourself for milestones. Hit your first $100k? Take a weekend trip to celebrate.

Member discussion